The Curated News Hub

Your daily source for diverse news and insights.

Whole Life Insurance: A Policy for the Unpredictable Journey of Life

Discover why Whole Life Insurance is your safety net for life's surprises. Secure your future today for peace of mind tomorrow!

Understanding the Benefits of Whole Life Insurance: Is It Right for You?

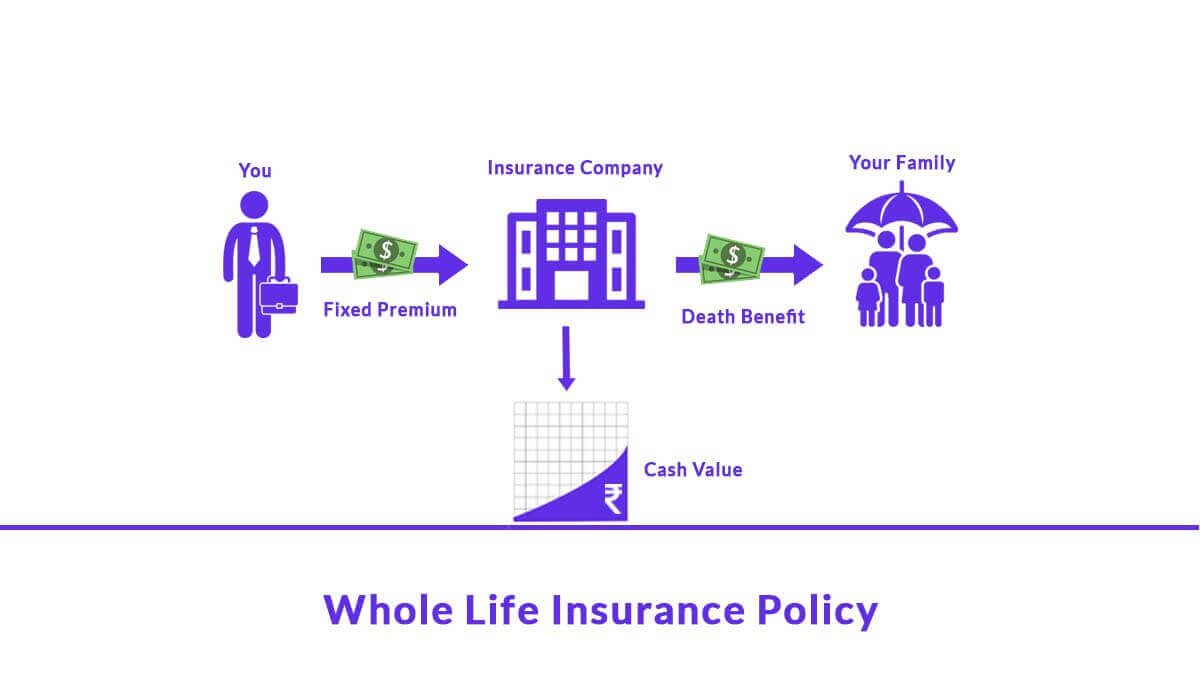

Whole life insurance is a type of permanent life insurance that offers numerous benefits, making it an appealing option for many individuals. Unlike term life insurance, which provides coverage for a specific period, whole life insurance is designed to last for the policyholder's entire life, as long as premiums are paid. One of the main advantages is the cash value component that grows over time, allowing policyholders to borrow against it or withdraw funds if needed. Moreover, whole life insurance policies often come with fixed premiums, ensuring that your payments remain the same throughout the policy's lifespan, which can be a significant advantage for long-term financial planning.

Deciding whether whole life insurance is right for you depends on various factors, including your financial goals and family needs. Here are a few key considerations to help you evaluate your options:

- Financial Security: Whole life insurance provides a death benefit that can support your loved ones financially in the event of your passing.

- Investment Growth: The cash value accumulates at a guaranteed rate, providing a sense of security and an opportunity for growth.

- Estate Planning: It can be a useful tool in estate planning, allowing for tax-efficient transfers of wealth.

Ultimately, understanding these benefits will empower you to make an informed decision about integrating whole life insurance into your financial strategy.

Whole Life Insurance vs. Term Life Insurance: Which One Should You Choose?

When it comes to choosing between Whole Life Insurance and Term Life Insurance, it's essential to understand the key differences and how they fit into your financial strategy. Whole Life Insurance provides lifelong coverage and includes a savings component, which allows you to build cash value over time. This option is often more expensive due to its permanent nature, making it suitable for individuals who are committed to long-term financial planning. In contrast, Term Life Insurance offers coverage for a specific period (usually 10, 20, or 30 years) and is typically more affordable. This type of policy is ideal for those looking for temporary coverage to protect their family during critical years, such as until children are financially independent.

Ultimately, the decision between Whole Life Insurance and Term Life Insurance hinges on your personal circumstances and financial goals. If you desire lifelong coverage and are willing to invest in a policy with a cash value component, then Whole Life Insurance might be the right choice. Conversely, if you're seeking a cost-effective solution that provides financial protection for a designated period, Term Life Insurance could be more suitable. Carefully evaluating your needs and consulting with a financial advisor can help you make an informed decision that aligns with your long-term financial objectives.

Top 5 Misconceptions About Whole Life Insurance Debunked

When it comes to whole life insurance, misconceptions can cloud understanding and lead potential policyholders astray. One major myth is that whole life insurance is an investment rather than a mere insurance product. While it does accumulate cash value over time, its primary purpose is to provide lifelong coverage and peace of mind to loved ones after you pass away. The cash value is simply a beneficial feature that can be accessed under certain conditions, making it essential to view whole life insurance through the lens of protection and not just potential financial gains.

Another common misunderstanding is that whole life insurance is significantly more expensive than term life insurance. While premiums for whole life insurance are typically higher, they are designed to reflect lifelong coverage and the cash value that builds over time. In fact, when considering the long-term benefits and the stability of lifelong protection, whole life insurance can be a more strategic choice for many individuals. Understanding the interplay between cost and benefit is crucial for making an informed decision about your life insurance needs.